Helpful information about Gift Aid

If you pay enough/sufficient UK tax on income or capital gains, or on a pension, then please consider Gift Aiding your donations.

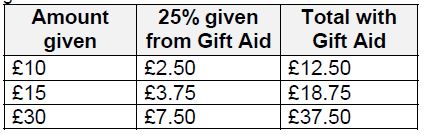

Gift Aid is a reclaim against your donation from HMRC on the tax that you have already paid. For every £1 that you donate, we can reclaim 25p, and it doesn’t cost you a penny!

Here are some examples of how much extra money your parish and preferred appeals could get:

You have nothing to lose and everything to gain for the benefit of your parish and our fundraising appeals!

There are many misconceptions about Gift aid. But did you know that:

- If you pay enough/sufficient UK tax on a pension then you can Gift Aid your donations.

- Your taxes will not go up if you Gift Aid; your records will not be scrutinised and you won’t have to pay anything or do anything further after signing a declaration form.

- Signing up to Gift Aid means your details are run through HMRC’s database simply to check you are on there. This does not trigger any further checks.

- Gift Aid is a wonderful means of boosting your giving at no extra cost on your part and makes a real difference to the financial wellbeing of your parish and our appeals.

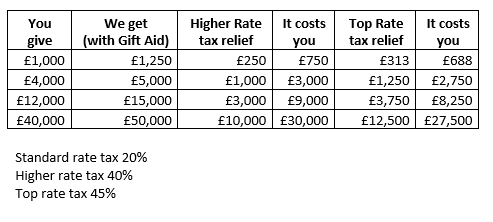

- Gift Aid benefits higher rate tax payers too, as it allows you to reclaim the difference between the basic and higher rate of tax for yourself when you complete your tax return. Please have a look at the table below which gives examples of how higher and top rate tax payers can benefit by Gift Aiding your donations.

- Donations made by or for a company are not eligible for Gift Aid. Only personal donations are eligible for Gift Aid.

If you would like your donations to your parish or Diocesan appeals to be Gift Aided, there are a few ways you can let us know:

- If you make your donations using the online donation form, please make sure you tick Yes to Gift Aid

- If you make your donations using a contactless giving device in your parish, please complete your details (your Full Name, Full Address and Postcode) either on the device or on the corresponding webpage (your parish will have leaflet and posters with the QR code and/or web address)

- If you are completing a new Standing Order form, please tick yes and complete your details and return to your parish office, or for Diocesan appeals please send to the address on the form.

- If you give by standing order or bank transfer, but have not yet signed a Gift Aid declaration, please email giftaid@rcdow.org.uk with:

o Your parish name/The name of the appeal you are giving to

o Your title, first name and surname

o Your address and postcode

o The date of your gift, or start date of Standing Order

o The amount of your donation/s

o Please add the line: ‘Please Gift Aid my donations’

For your declaration to be eligible for us to claim the Gift Aid, we need your Full Name, your Full Address and postcode. We also need your email address (if you have one) so that we can email you confirmation of your Gift Aid Declaration.

Tax relief for higher and top rate tax donors - how to reduce the cost of your donations: